I was sitting in the exam room and the doctor walked in. Knowing I write this blog, he said, “Finally someone I can talk to. What the heck is going on?”

With our current economic situation, the market tanking and the Coronavirus monopolizing the amped up media, a lot of concerned subscribers are asking that question.

When you combine financial and health concerns, with the never-ending political hysteria and out of control Federal Reserve, you hope emotional, knee-jerk reactions don’t cause bigger problems. We have never seen such a mess in our lifetime; we are in unchartered waters.

Subscriber Rick G. had some 4% bonds called in. “What should I do with the money? The bond market is too scary, sure don’t want to touch the stock market at the moment and 10-year CDs won’t keep up with inflation.”

The working class cannot afford expensive knee-jerk reactions in a crisis; the cost of a mistake can be much too high.

I’m lucky to have good friend Chuck Butler in times like this. His inbox is also pretty full.

While none of us knows what is going to happen, we can make some educated guesses.

DENNIS: Chuck, our readers are trying to make their life savings last, retire comfortably – and not lose their money.

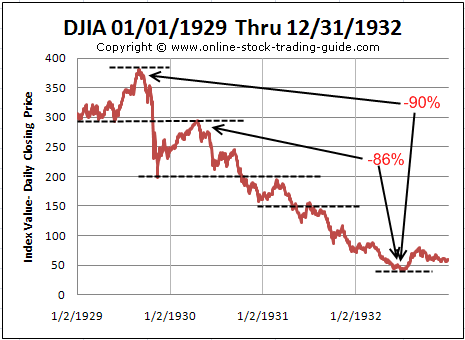

I saw some Great Depression charts. The first one was depicting what they called the “dead cat bounce”:

Chuck, can you describe the “dead cat bounce” for our readers. It looks like a lot of investors got really hurt after the 1929 crash by jumping back into the market too early.

CHUCK: Thanks Dennis for this opportunity to pass along my thoughts!

Webster’s defines it this way: “a brief and insignificant recovery (as of stock prices) after a steep decline.”

A Dead Cat Bounce (no cats were harmed) is like dropping a tennis ball off of a tall building. The ball would bounce, and then drop and bounce with less energy – and on and on. Look at the above chart and you see the tennis ball dropping, bouncing, then dropping some more, etc.

| “Stocks will rise (“a dead cat bounce”, the old timers call it) on the “bailout” news, and then give up another 50% of their value.” – Bill Bonner 3/20/2020 |

It burns my britches when I hear, “These are excellent levels to buy these undervalued stocks”. What? The market could drop another 5,000 points and still be overvalued if you asked me! The thought of them being “undervalued” is preposterous in my book!

What these guys are attempting to do is to be “the first one to call the bottom”. What if they’re wrong? Will they be publicly ridiculed and put in yolks? No…. they’ll just live another day and call another “bottom” and the sheeple will follow them – losing money in the process.

I tell my readers, don’t attempt to pick the bottom. Wait a bit and see if the rebound is for real. It’s better to be right. Don’t let the fear of missing out cost you money!

We’re all cooped up in our houses; computers are working overtime. People are probably reading more than they ever have, and they are itching to “do something” in the markets.

| Don’t “do something, just to do something” – It’s a fast way to end up being able to do nothing! |

DENNIS: Corporate America has been misleading investors by paying dividends and buying back stock with borrowed money. I feel, using the Coronavirus as an excuse, we are going to see a huge drop in corporate earnings. Losses they have been hiding will be written off like never before.

We will then see much lower earnings expectations. They will beat the low estimates, with much hoopla, and go back to collecting their bonuses.

Chuck, will that be the sign of the real market bottom? If that is the case, won’t that require investors to be very patient?

CHUCK: Yes, investors will need to be very patient now…. We’re all cooped up in our houses, and itching to do something… Be careful out there!

The way I’ve always used to see if a bottom has occurred, is this:

| Have all the bad things that caused the item to sell off been corrected? Or at least on the road to correction? |

If they haven’t, then you caught the dead cat bounce. It’s better to get in on the first floor of a high rise, there’s always many floors above you to still go! You may have missed getting in on the basement floor, but I’ve always found basements to be musty, and damp, and dark. I would rather walk into the first floor!

I used to write a letter called the Currency Capitalist for The Sovereign Society. I devoted an entire letter covering past market sell offs and how they tricked investors into thinking they got in on the bottom, only to find out they didn’t. Readers may be able to find it in the archives.

The goal is to get it right – be patient!

DENNIS: Our friend Rick G. remarked, “I was lectured yesterday by my broker #1 (age 36) and my broker #2 (age 28). Stay the course the markets will return.”

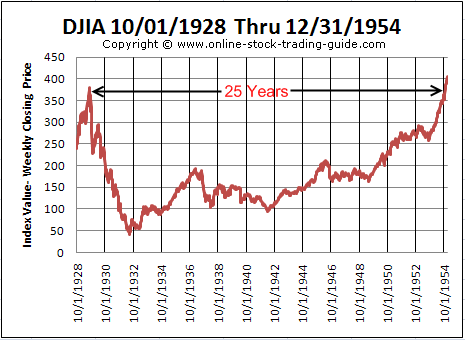

This depression chart is pretty telling:

The casino banks don’t want investors pulling their money out. I suspect the Wall Street money managers are telling brokers to keep their clients invested while they are bailing and shorting the market driving prices down even further.

I see a red flag. If a stock broker “lectured me” I would ask them if they can guarantee it will come back in my lifetime. Why no stop losses to reduce the probability of catastrophic losses?

Chuck, am I missing something?

CHUCK: Dennis, no you’re not missing anything…. I understand that the stock market will rebound eventually – but no one knows how long it will take. It took 25 years in 1932 and (adjusted for inflation) almost 20 years after the 1999 crash. It’s an unknown, and I don’t like unknowns….

If and when you do decide to get in on the first floor, do so only with a renewed passion to know all about the company who’s stock you’re thinking of buying. Then after buying it decide how much risk you’re willing to take, and place a stop/limit order and then walk away.

Your kids, or the charity that you leave everything to will be grateful that you were so prudent with your investments.

DENNIS: Rahm Emanuel preached, “You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before.”

That infuriates me. Under the emotional stress of a crisis, politicos pull crap that would never fly under less stressful conditions – for their own political gain.

I was upset by this Wall Street On Parade article that warns:

“Without one vote by an elected official, the Federal Reserve just became a brand new national legislative body. It will, without any oversight in Congress, decide what corporations and businesses to save and which to let fail.

While the corporations and small businesses will receive “billions,” Wall Street’s mega banks and trading houses will, once again, have trillions of dollars of toxic securities removed from their balance sheets, including plunging stocks through the Fed’s Primary Dealer Credit Facility.”

Chuck, isn’t this just going to make things even worse?

CHUCK: OMG! Yes, this Primary Dealer Credit Facility, is also known on Wall Street as “cash for trash”…. I recently wrote in my daily letter about how the Fed will be taking on stocks, and deciding who gets to remain in business and who doesn’t….

Did we vote on this new ability for the Fed, and I was napping? Of course not! But it is what it is now folks…. Not only will the Plunge Protection Team be buying stocks, but also the Fed…. Talk about the lack of free markets!

Everything manipulated, from now on will be our new mantra for all markets. I want no part of this scenario, I’m screaming, “serenity now!”

| No matter how much stock buying the Fed and PPT do, a bad company is a bad company, and eventually that will end up in tears for their stockholders. Don’t let the sun catch you crying… |

DENNIS: Unfortunately, we have no control over the government; however, we can try to control our emotions and investments.

I’m avoiding the stock market and investing in short term CDs. I am not earning much but trying to keep from losing money. I sure don’t want to go back into the market until after the election shakes out.

What are you telling your readers? How should we protect ourselves?

CHUCK: Dennis, for now, I’m sticking to short term CD’s and cash. (There’s no harm in holding cash, as long as your bank isn’t charging you to do so, which is probably coming down the road, so be prepared!) I want to remain liquid and slowly reinvest on the first floor when the time comes. If we’re going to stay away from stocks and bonds, that leaves, cash and Gold & Silver…. Got Gold?

| Back in 2007-08 crash we said, “A return OF capital” is more important right now than a “return ON Capital”. I think I’ll pull that one out of storage and use it again! |

DENNIS: Chuck, thanks again for your time.

CHUCK: My pleasure.

Dennis here. Remember if you have cash and the market goes up, you really have not lost a dime. I agree with Chuck; stay liquid, be patient, and great buying opportunities will appear.