Airlines seem poised for a revival, but how long before their stocks to take off? The U.S. economy is undoubtedly recovering from the coronavirus pandemic. Jobless claims are at their lowest level since the country essentially shut down due to slow the spread of COVID-19.

What’s more, 40% of adults in the U.S. are now fully vaccinated. Many states have rolled back some or all of their pandemic-related restrictions. Food and beverage businesses are seeing a resurgence and are even having trouble finding employees.

So does that mean airlines are next?

Air travel has clearly picked up lately. First-quarter results for the major airline groups showed vast improvement from the previous quarter. What was probably most attractive to prospective investors was the increase in summer travel demand. As the weather heats up, so could the airline stocks.

The question is: is buying an airline stock the right move? Higher demand doesn’t necessarily mean higher profits if costs are also rising at the same time. The summer also tends to bring an increase in fuel prices. Moreover, in terms of generating profits, air travel is a tough business in even the best of times.

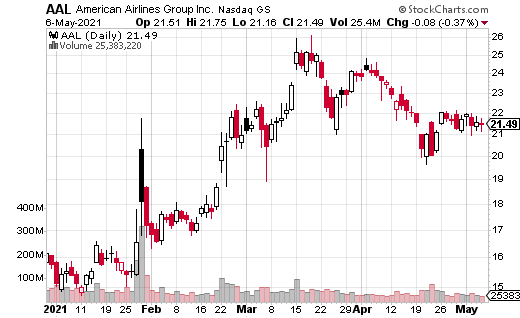

Nevertheless, airlines should have plenty of upside remaining. Take American Airlines (AAL). The stock is up 37% for the year, but still well its below pre-pandemic levels. While the share price isn’t likely to skyrocket anytime soon, it may continue to drift higher. The problem is, investors aren’t earning any income on AAL—it doesn’t pay a dividend.

Fortunately, this situation is an ideal time for using covered calls. AAL isn’t likely to jump higher, but the industry’s economics are improving. The stock doesn’t pay a dividend. This scenario virtually screams for a buy/write.

In fact, a large covered call traded last week, likely based on the factors I just mentioned. With the stock trading at $21.26, the January 2022 calls were sold at the 25 strike. The calls were sold 3,800 times for $2.14.

So why is this covered call trade ideal for AAL? First off, the position can’t lose money unless AAL drops below $19.12, but it can earn profits from share appreciation up to $25. Given the positive trend in airlines, it appears to be a relatively safe trade that can still make more than 17% through next January in share price upside alone.

Even better, the trade generates a yield of 10% from the calls sold. This trade will expire in roughly nine months, so 10% in income for just nine months is quite robust, especially in an ultra-low-rate environment.

All told, if AAL is above $25 by January expiration, the position can earn almost 28% in profits. It can also do so with less risk than just owning the stock. Unless an investor thinks AAL’s price is going to the moon, it appears that using a covered call trade is far superior to simply buying the stock.