This is the sixth (and final) comparison article in my current series. You can find the previous ones here.

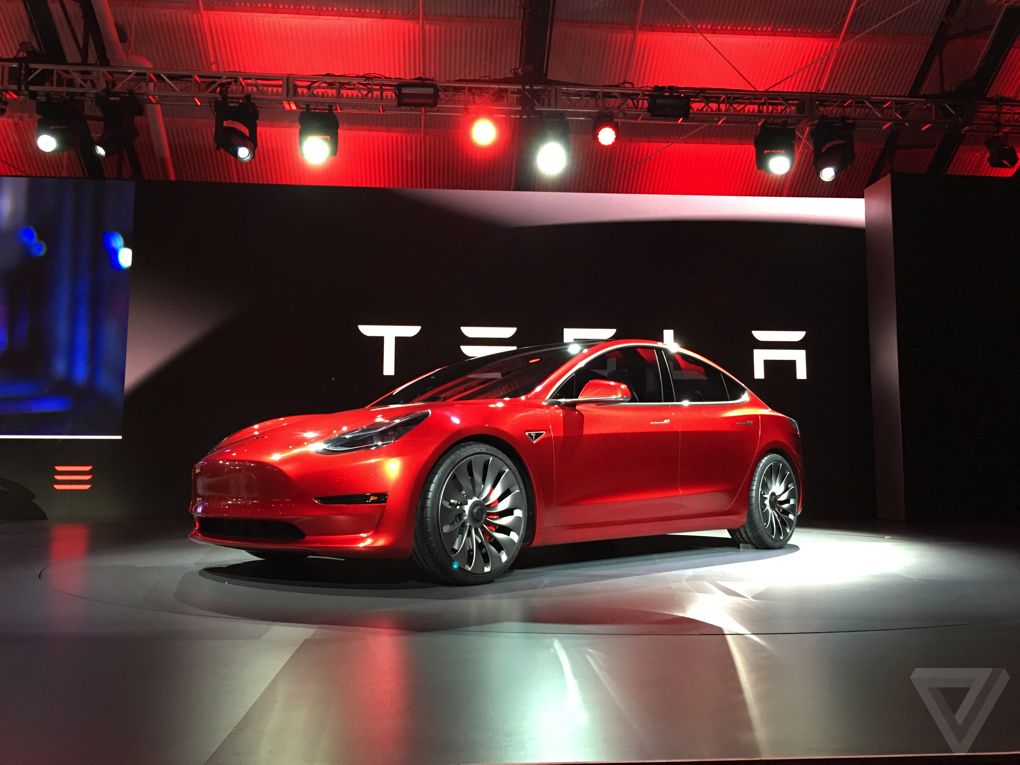

This will be the end of the series in which I compare single-stock ETF results. I have enjoyed putting together my “dog fight” series of articles, comparing the results of ETFs operating in the new category of single-stock, covered-call funds. Today, let’s compare two ETFs that have Tesla (TSLA) as the underlying stock.

The new category of single-stock covered-call ETFs has two sponsors offering competing funds covering the same underlying stocks. This type of ETF is new in the market, with the oldest funds operating for about two years. The newer family of ETFs launched about a year ago. The funds have been trading long enough to compare returns for covered call ETFs with the same underlying stock.

The YieldMax ETFs were the first mover with this type of ETF, launching their first funds in November 2022. Currently, YieldMax offers 27 single-stock ETFs, including a few inverse/short funds that go up when the underlying stock goes down. These funds’ eye-popping distribution yields have caught investors’ attention.

The six Kurv single-stock covered call ETFs launched at the end of October 2023. These funds have lower distribution yields, but the stock price charts for the last four-plus months have very positive slopes.

With almost twelve months of track records, I have been comparing the returns of the YieldMax and Kurv funds covering the same stocks.

This week, I will compare the two Tesla (TSLA) covered call ETF returns since November 1, 2023.

The current quoted yield for the YieldMax TSLA Option Income Strategy ETF (TSLY) is 125.52%. That is not a typo. Since November 1, 2023, the TSLY share price has declined by 49.7%. With the covered call strategy dividends, the TSLY total return manages to post a positive 3.6% return. Tesla (TSLA) went through massive swings over the last year, with a 52-week low of $138.80 and a high of $271.00. Selling calls through that type of volatility gave returns well short of the declared yields. However, over the last year, TSLY outperformed TSLA by 16%.

The Kurv Yield Premium Strategy Tesla (TSLA) ETF (TSLP) shows a current distribution rate of 25.91%. That’s a fraction of the current yield quote for TSLY. From November 1 through October 2, TSLP’s share price declined by 14.3%. Over the period, including the dividends, TSLP put up a total return of 8.8%. TSLP slightly outperformed TSLY, and both performed better than TSLA. However, it was a wild ride for all three investments.

This is the sixth comparison out of the six Kurv covered call ETFs. Three of the comparisons—Amazon, Apple, and Netflix—were basically ties. The Kurv ETF is the clear winner between the two Alphabet/Google covered call funds, and YieldMax won the day with the Microsoft covered call ETFs. For the final comparison, I give the win to the Kurv ETF, TSLP.

I will also track comparisons over the longer term. I’ll share that information with subscribers to my ETF Income Edge service.

#1 missed question at the Presidential debate (could cost the race!)

I can’t believe no one asked this question at the debate. “How are you going to put more cash in Americans' pockets to handle inflation?” Lucky for you, I’ve gone ahead and answered the question myself - Here’s how you can collect 20 income payouts from now until Election day (potentially up to $2,329.10!) Click here to see my “more cash in your pocket” plan.