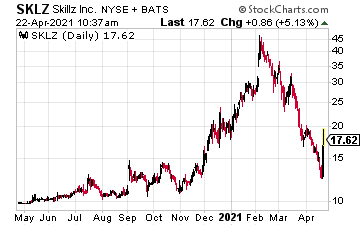

Skillz (SKLZ), the mobile games platform, had seen its share price plummeting since it’s all time high in early February. Now SKLZ is racing higher after releasing its outlook for the first quarter. For the quarter, the company expects to post revenue of $80 million, which is above an analyst range of $72.2 million to $79.6 million.

The company also expects the number of monthly average users (MAUs) to increase to 2.6 million, which falls in between an analyst range of 2.4 million to 3.2 million. It also expects for paying MAUs to have increased to 450,000, which falls in an estimated range of 442,000 to 469,000.

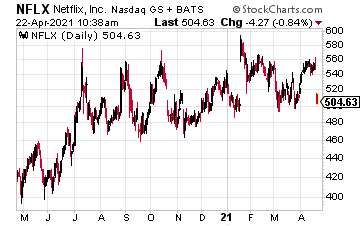

Netflix (NFLX) fell about $37 after only adding 3.98 million new subscribers, which was well below expectations for 6.29 million. However, Q1 revenue did jump to $7.16 billion, as compared to expectations for $7.14 billion. EPS was up to $3.75, as compared to expectations for $2.98. In addition, guidance was weak.

According to a Netflix press release, “Guidance for user growth in the second quarter was also weak compared to consensus expectations. The company said it anticipates second-quarter paid users will grow by just 1 million, compared to Wall Street’s expectations for 4.44 million.”

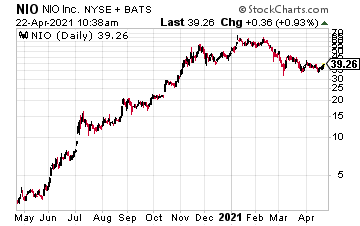

Nio Inc. (NIO) is accelerating after Mizuho analyst Vijay Rakesh rated the stock a buy. “Despite well-publicized and industry-wide supply problems with semiconductors needed for car production, Rakesh believes the company’s sales are likely to “remain strong through 2021E,” roughly doubling through year-end even if production slows somewhat in near-term Q2, as the industry works out the kinks in its semiconductor supply chain,” reported Tip Ranks.

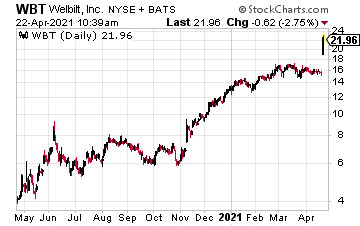

Shares of Welbit Inc. (WBT) were up 41% on news it’s being acquired by Middleby for $2.9 billion in an all-stock transaction.

According to a Middleby press release, “The combined company will have approximately $3.7 billion in combined 2020 sales, 73% of which will come from the Commercial Foodservice segment. With a strong balance sheet and robust cash generation, Middleby will be well positioned and capitalized to support significant R&D and future acquisition opportunities. Middleby has a long track record of successfully integrating businesses, having completed over 20 acquisitions since 2018, and has a history of driving efficiencies in acquired companies.”

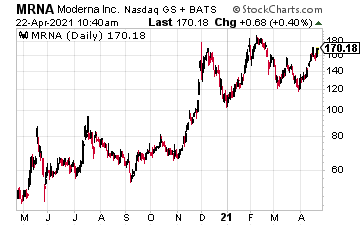

Moderna Inc. (MRNA) was higher on news of a new supply agreement with Israel for 2022. “The announcement follows two earlier agreements between Israel and Moderna to supply a total of 10 million doses of the CV Vaccine Moderna,” as reported in a company press release.

At the time of this writing, Ian Cooper did not hold a position in any of the noted stocks.