One of my favorite long-term macroeconomic plays is the worldwide growth of the pet care industry.

The sector was already growing rapidly, but the coronavirus pandemic has only accelerated its growth. There was, for example, a 13% year-over-year net increase in dog adoptions in 2020, based on consolidated shelter data and American Kennel Club records. The entire pet care industry was one of the few sectors that experienced growth in 2020, and it continued to show promise in 2021.

One of the major trends—especially among millennials and Gen Z—is the humanization of pet care, driving demand for similar levels of quality of care for animals as for people. This has created a push for things like human-grade pet food and greater options in veterinary care.

Globally, the pet care industry is forecast to have a value in sales of $148 billion by 2025 (according to research from Research and Markets) as pet owners continue to prioritize their companions’ needs. Here in the U.S., according to The American Pet Products Association (APPA), overall spending on pets rose from $90.5 billion in 2018 to $99 billion last year.

Premium pet food and treats have recorded increased growth year over year, with pet food that has additional therapeutic uses recording even higher continued growth.

On the animal healthcare side of things, increasing options for diagnostic testing and services have given rise to companies such as Idexx Laboratories (IDXX), which offers in-office testing kits to veterinarians.

And then there are the veterinary pharmaceutical companies. According to the APPA, the current market for animal medicines is estimated to be worth between $24 billion and $30 billion a year. While some forecasters say that market will keep growing at about a 5% annual clip over the next decade, researcher Global Market Insights says that growth will be much faster—about 7% per year, which will take this market to more than $45 billion by 2024.

The King of Pet Meds

The leading global animal medicine company is Zoetis (ZTS), a 2013 spinoff from Pfizer (PFE).

Zoetis is building on more than 65 years of experience of delivering quality animal medicines, vaccines, and diagnostic products, complemented by biodevices, genetic tests, and precision livestock farming.

The company has about 300 product lines, which it sells in more than 100 countries. These include five specific categories: anti-infectives, vaccines, parasiticides, medicated feed additives, and other pharmaceuticals. Zoetis’ annual revenue in 2020 was $6.7 billion, with 55% of the total coming from domestic pets and 44% from farm animals.

Zoetis was definitely a pandemic winner. The pet-therapy side of its business experienced double-digit operational growth through 2020.

Perhaps Zoetis’s biggest advantage is that the company is free to develop therapeutics based on unmet animal needs. There are sizable opportunities related to unmet animal needs that Zoetis can pioneer. For example, after it was unveiled in 2014, Apoquel quickly grabbed 47% of the market for the treatment of atopic dermatitis in dogs.

Apoquel is often paired with another Zoetis drug—an injectable medication called Cytopoint, which also uses monoclonal antibodies (mAB therapy)—to produce fewer side effects. Cytopoint gives dogs afflicted atopic dermatitis as much as eight weeks of relief. It’s the first such therapy approved by both the FDA and the European Union.

There was also the successful launch of Simparica Trio, a flea-and-tick treatment for dogs, which really boosted Zoetis’ bottom line.

Keep in mind that, although patents are not essential for maintaining a product in the animal health industry, at least 20% of the company’s revenue comes from products protected by patents. This allows Zoetis to charge a premium price and protect itself from competition.

Finally, as Zoetis has moved into biologic therapeutics for pets, the difficulty and cost involved with creating competitive biosimilars will limit competition—even after any patents have expired.

Buy Zoetis

Zoetis is the undisputed leader in the global animal health industry. It has set itself apart based on its impressive innovation that shows up across its product portfolio, including a number of drugs for specific pet ailments, such as separation anxiety. The company has also expanded its presence into virtually every type of animal-related health market, such as aquaculture and pet diagnostics.

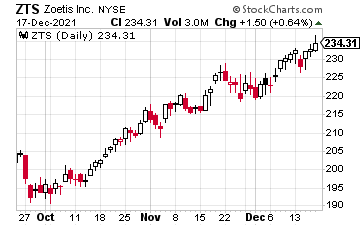

Zoetis’ stock—despite overall stock market weakness—keeps moving to record highs.

And, the company did recently announce a $3.5 billion share-repurchase plan. That will follow an existing $2 billion buyback program that was announced about three years ago and is expected to be completed next year.

The Zoetis board also approved a nice, 30% increase in its quarterly dividend. The new payout will be $0.32.5 per share, or $1.30 on an annualized basis, up from the $1 a share previously. The yield is still tiny—0.56%—but the message it sends is what’s important.

I expect Zoetis to grow faster than the industry and maintain above-average margins due to its scale and its shift toward the faster-growing companion animal segment. The stock is a buy at $230 a share or below.