The need for instant gratification has spilled over into the world of investing. The GameStop (GME) saga was the culmination of a world in which both the financial media and social media focus on short-term news and “advice.”

I hear it from many of my subscribers who see the news and hype around stocks like GME and they’re looking for quick wins with their investments. While the news may seem like it’s easy to make big gains in the markets, it’s not. Life is a long-term process, and I suggest your investment strategy match that timeframe.

As you follow financial news, focus on words that sound more like gambling than investing. I hear phrases like “take a chance” or “is this stock a good bet?” or “the odds” every hour my television is tuned to a financial news. On the flip side, watch to see how often there is a discussion of holding an investment for the long term, or of long-term investment strategies. It rarely happens.

The financial news has evolved to be entertainment and little else. They want eyeballs just like every other media, so they talk about hot stocks and fast-moving news items—not about investment ideas and themes you can use to meet your long term goals.

I suggest that instead of trying to find/guess the next hot stock pick, you think about your financial goals and then put together investment strategies with a high probability to get you there. If you plan to retire in five or 10 years, or you need a retirement income to last for 30-plus years, looking for short term investment ideas will not get you to where you want to go.

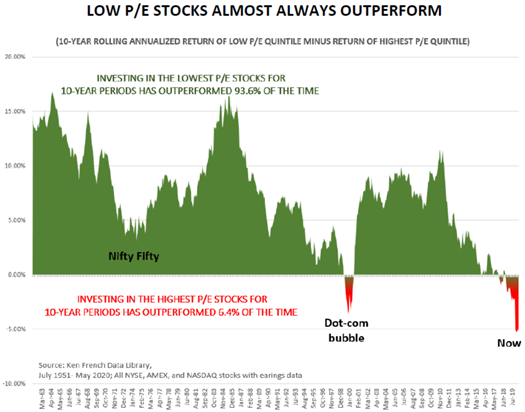

While value investing remains tremendously out of favor, at least in the news, you may be surprised that for long term results, value beats growth more than 93% of the time. Here is a chart recently sent out by Tim Travis of TT Capital Management.

Note that the results use ten-year periods. Over the long term, value wins. My preferred value strategy is to invest in dividend growth stocks. The goal is to select stocks with share prices below the level indicated by the yield and dividend growth history.

Just because investing for value looks slow and tedious doesn’t mean you won’t get very attractive returns.

NextEra Energy Partners (NEP), a renewable energy yieldco, has been a nice winner in my dividend growth focused service. By nice, I mean that over the last five years, NextEra posted a 222% total return. That works out to 25.8% annual compound growth. I swear, this is a dull dividend growth investment!

Start listening to the financial news with a more discerning ear. See how much they push towards trading that sounds like gambling. Then ignore that news and put together a long-term investment strategy that will let you be successful and wealthy for the rest of your life.