The first two months of 2021 were marked by heightened stock market volatility. I am sure you watched the GameStop stock price game, where billions were made and then lost.

Shares of high-flying Tesla (TSLA) have lost 20% in a few short weeks. For investors who bought at $900, looking at a $700 share price illustrates the current market’s dangers. No matter what you hear “experts” predict on the financial news, I suspect they will be more wrong than right.

On the flip side of the roller-coaster stock market, it is challenging to find investments that protect your capital and pay any sort of return. Once again, the financial news is all atwitter because the 10-year Treasury yield has climbed to 1.4%. I don’t know about you, but I do not view 1.4% as an acceptable return on my money. And shorter-term “safe” investment are yieldingmuch less than one percent—for example, 0.08% (yes, eight basis points) for the one-year Treasury.

To counter both high stock market volatility and low yields on safe investments, consider putting some of your portfolio into dividend-paying investments. With income stocks, you can select from a gamut that runs from conservative to aggressive, and at the same time, you can count on regular cash deposits into your brokerage account.

Dividends provide guaranteed returns into your account, which, when the stock market gets ugly, can be a life raft of income and cash that will keep you from making rash investment decisions.

Let’s look at some categories and their representative yields.

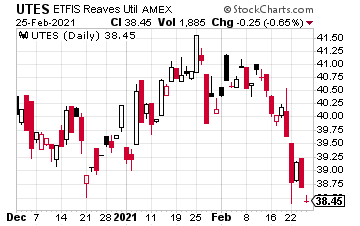

Utility stocks pay regular and growing dividends at roughly double the yield of the 10-year Treasury. For example, the Virtus Reaves Utilities ETF (UTES) has a current yield of 2.6%. The folks at Reaves actively manage the fund and are the best in the business concerning utility company analysis. I have had portfolio managers from Reaves join me for private conference calls with my subscribers.

(A quick note here. For each of these income investment categories, I share with my Dividend Hunter subscribers individual investments that provide better yields combined with lower risk factors.)

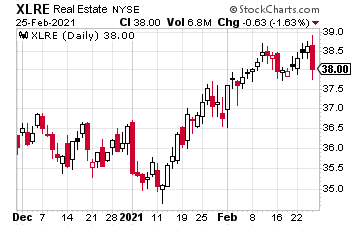

Equity real estate investment trusts (REITs) own commercial properties, and by law must pay out 90% of net income as dividends to investors. You can diversify by type of property, such as apartments, offices, medical centers, or even timberland. REITs typically pay steadily growing dividends. The Real Estate Select Sector SPDR ETF (XLRE) currently yields 3.0%.

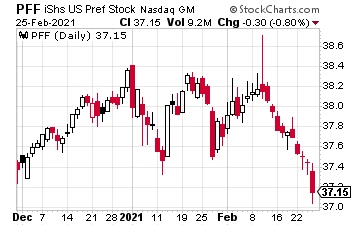

Preferred stocks pay safe dividends. Preferreds have first call for payments over common stock dividends, and a company cannot reduce or change preferred stock dividend rates. Preferred stock yields are fixed, so there’s no dividend growth, but that’s in exchange for highly secure dividend payments. The iShares Preferred and Income Securities ETF (PFF) yields just under 5%. To my subscribers, I recommend a list of selected individual preferred stocks that average over 7%.

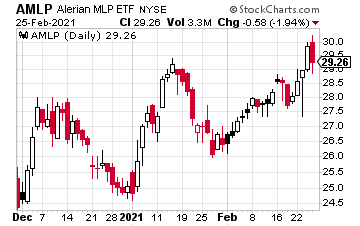

Finally, here is one aggressive high-yield category: Along with the rest of the energy sector, energy midstream and infrastructure stocks were hammered in 2020. However, midstream companies pay steady dividends, and payments to investors continued through 2020. With values down, yields are very high. For example, the ALPS Alerian MLP ETF (AMLP) yields over 9%.