Our covered call recommendations service – Weekly Income Accelerator – is popular with investors who have not previously traded options. Doing covered calls for extra income is a natural extension of the high-yield investing strategy I lead with the Dividend Hunter service.

If you are like many who join us, you may quickly find that your brokerage account doesn’t currently let you trade options. We can fix that.

To be able to trade options, the brokerage firm with which you have your investment account must grant you options trading authorization. Your broker requires additional information and an application to become options authorized.

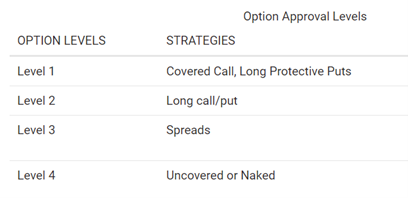

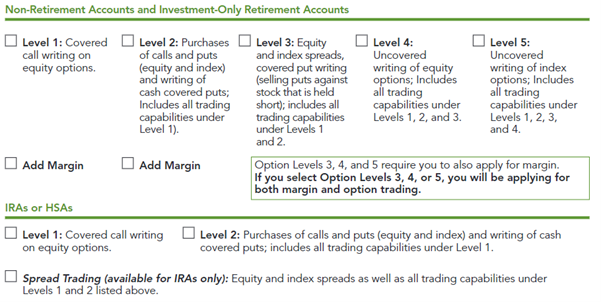

Brokers assign a range of options trading authorization levels. Your broker will have four or five different levels. Like many things in investing, each broker assigns levels a little differently. Here are three examples.

This table is from Investorplace:

Our friends at Fidelity offer different levels between regular and retirement brokerage accounts:

The folks at Charles Schwab decided that creating a Level 0 (zero) for covered calls makes more sense than just using Level 1, like other brokerages. It does not, but that’s how they roll:

The obtain authorization, you either fill out an authorization request form or give your information over the phone to a broker’s registered representative. I suggest calling first to determine the easiest path.

Here is the best news: you only need options trading Level 1 for covered calls. Anyone with a brokerage account and money to invest will be approved at a minimum for Level 1 (Level 0 at Schwab) options trading.

Even if you currently don’t have plans to trade options, it is a good idea to have options authorization added to your brokerage account. At some point, circumstances may turn your authorization into a feature that becomes important to your financial health.