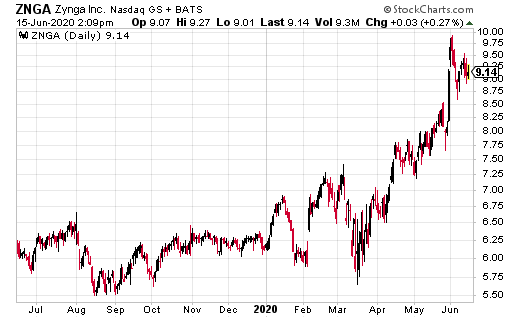

Zynga Inc. (ZNGA) is still one of the most explosive gaming stocks on the market.

Since bottoming out in March 2020 at $5.65, the ZNGA stock price is now up to $9.10 – and accelerating higher. Not only did ZNGA just buy Peak for $1.8 billion, giving it access to a popular lineup of puzzle games, it just partnered with Snap Inc.’s gaming platform, Snap Games.

“Snap Games is such a unique and exciting platform where players can jump right into highly-social, snackable experiences,” said Bernard Kim, President of Publishing at Zynga. “After creating Tiny Royale last year, we had a ton of ideas for more game concepts that we could bring to the platform. We’re thrilled to develop a slew of new titles for the Snapchat community, starting with Bumped Out, and to have the opportunity to innovate new social game mechanics, helping to build out the Snap Games ecosystem.”

Plus, demand for mobile gaming has been incredibly explosive.

More than 2.7 billion global gamers are expected to spend nearly $160 billion on games just this year, according to market researcher Newzoo. Better, mobile gaming could generate up to $77.2 billion this year – 13.9% growth year over year.

ZNGA Earnings Are Solid

Zynga posted a first quarter loss of $103.9 million, or 11 cents a share, as compared with a year-earlier loss of $128.8 million, or 14 cents. Revenue rocketed 52% higher to $403.8 million from $265.4 million year over year. Analysts were only looking for a loss of a penny a share on sales of $389 million.

Related: ZNGA Earnings Show EPS Loss of 11 Cent Per Share

CEO Frank Gibeau estimates second quarter sales of $400 million, up 31% year-over-year, with bookings of $460 million, up $84 million year-over-year. “In Q2, we expect revenue of $400 million, up $94 million or 31% year-over-year, with bookings of $460 million, up $84 million or 22% year-over-year. Live services will drive our topline performance, led by our forever franchises, as well as the year-over-year additions of Merge Magic! and Game of Thrones Slots Casino,” he says.

As of this writing, Ian Cooper does not have a position in shares of ZNGA.